Advertisement

-

Published Date

October 31, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

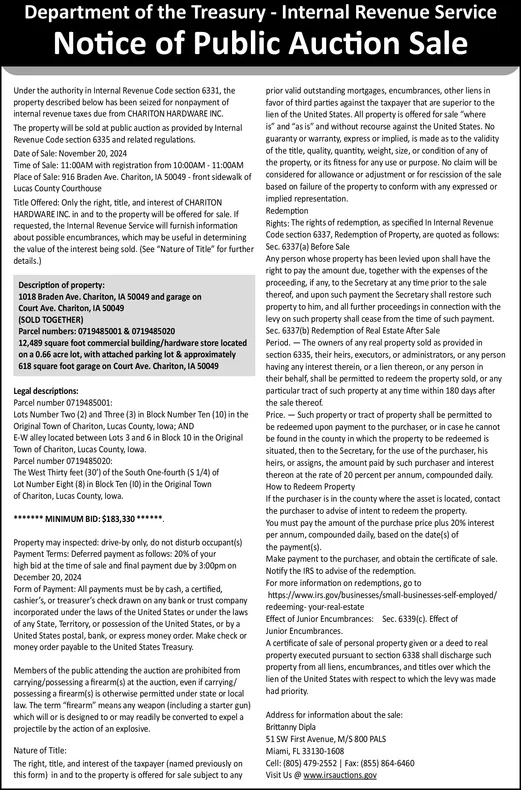

Department of the Treasury - Internal Revenue Service Notice of Public Auction Sale Under the authority in Internal Revenue Code section 6331, the property described below has been seized for nonpayment of internal revenue taxes due from CHARITON HARDWARE INC. The property will be sold at public auction as provided by Internal Revenue Code section 6335 and related regulations. Date of Sale: November 20, 2024 Time of Sale: 11:00AM with registration from 10:00AM - 11:00AM Place of Sale: 916 Braden Ave. Chariton, IA 50049-front sidewalk of Lucas County Courthouse Title Offered: Only the right, title, and interest of CHARITON HARDWARE INC. in and to the property will be offered for sale. If requested, the Internal Revenue Service will furnish information about possible encumbrances, which may be useful in determining the value of the interest being sold. (See "Nature of Title" for further details.) Description of property: 1018 Braden Ave. Chariton, IA 50049 and garage on Court Ave. Chariton, IA 50049 (SOLD TOGETHER) Parcel numbers: 0719485001 & 0719485020 12,489 square foot commercial building/hardware store located on a 0.66 acre lot, with attached parking lot & approximately 618 square foot garage on Court Ave. Chariton, IA 50049 Legal descriptions: Parcel number 0719485001: Lots Number Two (2) and Three (3) in Block Number Ten (10) in the Original Town of Chariton, Lucas County, Iowa; AND E-Walley located between Lots 3 and 6 in Block 10 in the Original Town of Chariton, Lucas County, Iowa. Parcel number 0719485020: The West Thirty feet (30') of the South One-fourth (S1/4) of Lot Number Eight (8) in Block Ten (10) in the Original Town of Chariton, Lucas County, Iowa. ******* MINIMUM BID: $183,330 ****** Property may inspected: drive-by only, do not disturb occupant(s) Payment Terms: Deferred payment as follows: 20% of your high bid at the time of sale and final payment due by 3:00pm on December 20, 2024 Form of Payment: All payments must be by cash, a certified, cashier's, or treasurer's check drawn on any bank or trust company incorporated under the laws of the United States or under the laws of any State, Territory, or possession of the United States, or by a United States postal, bank, or express money order. Make check or money order payable to the United States Treasury. Members of the public attending the auction are prohibited from carrying/possessing a firearm(s) at the auction, even if carrying/ possessing a firearm(s) is otherwise permitted under state or local law. The term "firearm" means any weapon (including a starter gun) which will or is designed to or may readily be converted to expel a projectile by the action of an explosive. Nature of Title: The right, title, and interest of the taxpayer (named previously on this form) in and to the property is offered for sale subject to any prior valid outstanding mortgages, encumbrances, other liens in favor of third parties against the taxpayer that are superior to the lien of the United States. All property is offered for sale "where is" and "as is" and without recourse against the United States. No guaranty or warranty, express or implied, is made as to the validity of the title, quality, quantity, weight, size, or condition of any of the property, or its fitness for any use or purpose. No claim will be considered for allowance or adjustment or for rescission of the sale based on failure of the property to conform with any expressed or implied representation. Redemption Rights: The rights of redemption, as specified In Internal Revenue Code section 6337, Redemption of Property, are quoted as follows: Sec. 6337(a) Before Sale Any person whose property has been levied upon shall have the right to pay the amount due, together with the expenses of the proceeding, if any, to the Secretary at any time prior to the sale thereof, and upon such payment the Secretary shall restore such property to him, and all further proceedings in connection with the levy on such property shall cease from the time of such payment. Sec. 6337(b) Redemption of Real Estate After Sale Period. The owners of any real property sold as provided in section 6335, their heirs, executors, or administrators, or any person having any interest therein, or a lien thereon, or any person in their behalf, shall be permitted to redeem the property sold, or any particular tract of such property at any time within 180 days after the sale thereof. Price. Such property or tract of property shall be permitted to be redeemed upon payment to the purchaser, or in case he cannot be found in the county in which the property to be redeemed is situated, then to the Secretary, for the use of the purchaser, his heirs, or assigns, the amount paid by such purchaser and interest thereon at the rate of 20 percent per annum, compounded daily. How to Redeem Property If the purchaser is in the county where the asset is located, contact the purchaser to advise of intent to redeem the property. You must pay the amount of the purchase price plus 20% interest per annum, compounded daily, based on the date(s) of the payment(s). Make payment to the purchaser, and obtain the certificate of sale. Notify the IRS to advise of the redemption. For more information on redemptions, go to https://www.irs.gov/businesses/small-businesses-self-employed/ redeeming-your-real-estate Effect of Junior Encumbrances: Sec. 6339(c). Effect of Junior Encumbrances. A certificate of sale of personal property given or a deed to real property executed pursuant to section 6338 shall discharge such property from all liens, encumbrances, and titles over which the lien of the United States with respect to which the levy was made had priority. Address for information about the sale: Brittanny Dipla 51 SW First Avenue, M/S 800 PALS Miami, FL 33130-1608 Cell: (805) 479-2552 | Fax: (855) 864-6460 Visit Us @ www.irsauctions.gov Department of the Treasury - Internal Revenue Service Notice of Public Auction Sale Under the authority in Internal Revenue Code section 6331 , the property described below has been seized for nonpayment of internal revenue taxes due from CHARITON HARDWARE INC . The property will be sold at public auction as provided by Internal Revenue Code section 6335 and related regulations . Date of Sale : November 20 , 2024 Time of Sale : 11:00 AM with registration from 10:00 AM - 11:00 AM Place of Sale : 916 Braden Ave. Chariton , IA 50049 - front sidewalk of Lucas County Courthouse Title Offered : Only the right , title , and interest of CHARITON HARDWARE INC . in and to the property will be offered for sale . If requested , the Internal Revenue Service will furnish information about possible encumbrances , which may be useful in determining the value of the interest being sold . ( See " Nature of Title " for further details . ) Description of property : 1018 Braden Ave. Chariton , IA 50049 and garage on Court Ave. Chariton , IA 50049 ( SOLD TOGETHER ) Parcel numbers : 0719485001 & 0719485020 12,489 square foot commercial building / hardware store located on a 0.66 acre lot , with attached parking lot & approximately 618 square foot garage on Court Ave. Chariton , IA 50049 Legal descriptions : Parcel number 0719485001 : Lots Number Two ( 2 ) and Three ( 3 ) in Block Number Ten ( 10 ) in the Original Town of Chariton , Lucas County , Iowa ; AND E - Walley located between Lots 3 and 6 in Block 10 in the Original Town of Chariton , Lucas County , Iowa . Parcel number 0719485020 : The West Thirty feet ( 30 ' ) of the South One - fourth ( S1 / 4 ) of Lot Number Eight ( 8 ) in Block Ten ( 10 ) in the Original Town of Chariton , Lucas County , Iowa . ******* MINIMUM BID : $ 183,330 ****** Property may inspected : drive - by only , do not disturb occupant ( s ) Payment Terms : Deferred payment as follows : 20 % of your high bid at the time of sale and final payment due by 3:00 pm on December 20 , 2024 Form of Payment : All payments must be by cash , a certified , cashier's , or treasurer's check drawn on any bank or trust company incorporated under the laws of the United States or under the laws of any State , Territory , or possession of the United States , or by a United States postal , bank , or express money order . Make check or money order payable to the United States Treasury . Members of the public attending the auction are prohibited from carrying / possessing a firearm ( s ) at the auction , even if carrying / possessing a firearm ( s ) is otherwise permitted under state or local law . The term " firearm " means any weapon ( including a starter gun ) which will or is designed to or may readily be converted to expel a projectile by the action of an explosive . Nature of Title : The right , title , and interest of the taxpayer ( named previously on this form ) in and to the property is offered for sale subject to any prior valid outstanding mortgages , encumbrances , other liens in favor of third parties against the taxpayer that are superior to the lien of the United States . All property is offered for sale " where is " and " as is " and without recourse against the United States . No guaranty or warranty , express or implied , is made as to the validity of the title , quality , quantity , weight , size , or condition of any of the property , or its fitness for any use or purpose . No claim will be considered for allowance or adjustment or for rescission of the sale based on failure of the property to conform with any expressed or implied representation . Redemption Rights : The rights of redemption , as specified In Internal Revenue Code section 6337 , Redemption of Property , are quoted as follows : Sec . 6337 ( a ) Before Sale Any person whose property has been levied upon shall have the right to pay the amount due , together with the expenses of the proceeding , if any , to the Secretary at any time prior to the sale thereof , and upon such payment the Secretary shall restore such property to him , and all further proceedings in connection with the levy on such property shall cease from the time of such payment . Sec . 6337 ( b ) Redemption of Real Estate After Sale Period . The owners of any real property sold as provided in section 6335 , their heirs , executors , or administrators , or any person having any interest therein , or a lien thereon , or any person in their behalf , shall be permitted to redeem the property sold , or any particular tract of such property at any time within 180 days after the sale thereof . Price . Such property or tract of property shall be permitted to be redeemed upon payment to the purchaser , or in case he cannot be found in the county in which the property to be redeemed is situated , then to the Secretary , for the use of the purchaser , his heirs , or assigns , the amount paid by such purchaser and interest thereon at the rate of 20 percent per annum , compounded daily . How to Redeem Property If the purchaser is in the county where the asset is located , contact the purchaser to advise of intent to redeem the property . You must pay the amount of the purchase price plus 20 % interest per annum , compounded daily , based on the date ( s ) of the payment ( s ) . Make payment to the purchaser , and obtain the certificate of sale . Notify the IRS to advise of the redemption . For more information on redemptions , go to https://www.irs.gov/businesses/small-businesses-self-employed/ redeeming - your - real - estate Effect of Junior Encumbrances : Sec . 6339 ( c ) . Effect of Junior Encumbrances . A certificate of sale of personal property given or a deed to real property executed pursuant to section 6338 shall discharge such property from all liens , encumbrances , and titles over which the lien of the United States with respect to which the levy was made had priority . Address for information about the sale : Brittanny Dipla 51 SW First Avenue , M / S 800 PALS Miami , FL 33130-1608 Cell : ( 805 ) 479-2552 | Fax : ( 855 ) 864-6460 Visit Us @ www.irsauctions.gov