Advertisement

-

Published Date

October 31, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

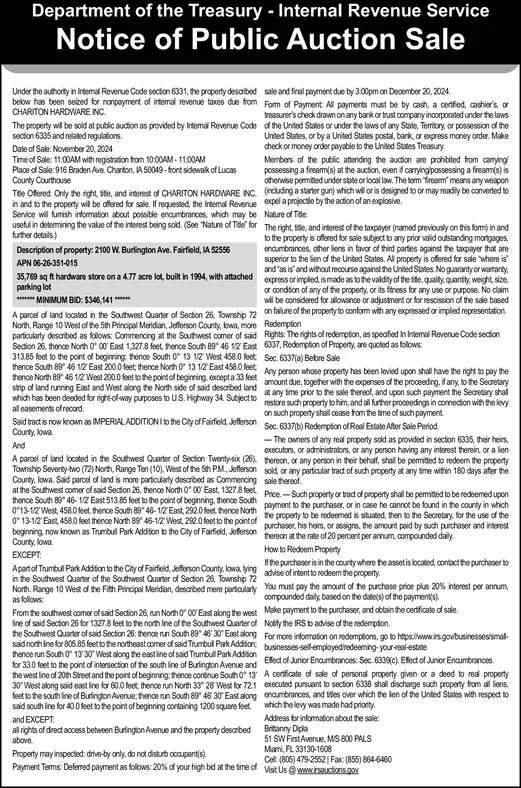

Department of the Treasury - Internal Revenue Service Notice of Public Auction Sale Under the authority in Internal Revenue Code section 6331, the property described below has been seized for nonpayment of internal revenue taxes due from CHARITON HARDWARE INC. sale and final payment due by 3:00pm on December 20, 2024. Form of Payment: All payments must be by cash, a certified, cashier's, or treasurer's check drawn on any bank or trust company incorporated under the laws The property will be sold at public auction as provided by Internal Revenue Code of the United States or under the laws of any State, Temitory, or possession of the section 6335 and related regulations. Date of Sale: November 20, 2024 Time of Sale: 11:00AM with registration from 10:00AM-11:00AM Place of Sale: 916 Braden Ave. Chariton, IA 50049-front sidewalk of Lucas County Courthouse Tile Offered: Only the right, ste, and interest of CHARITON HARDWARE INC. in and to the property will be offered for sale. If requested, the Internal Revenue Service will furnish information about possible encumbrances, which may be United States, or by a United States postal, bank, or express money order. Make check or money order payable to the United States Treasury. Members of the public attending the auction are prohibited from carrying/ possessing a firearm(s) at the auction, even if carrying possessing a fream(s) is otherwise permitted under state or local law. The term "firearm" means any weapon (including a starter gun) which will or is designed to or may readily be converted to expel a projectile by the action of an explosive. Nature of Tide: useful in determining the value of the interest being sold. (See "Nature of Tide" for The right, title, and interest of the taxpayer (named previously on this form) in and further details.) Description of property: 2100 W. Burlington Ave. Fairfield, IA 52556 APN 06-26-351-015 to the property is offered for sale subject to any prior valid outstanding mortgages, encumbrances, other liens in favor of third parties against the taxpayer that are superior to the lien of the United States. All property is offered for sale where is" and "as is" and without recourse against the United States. No guaranty or warranty, 35,769 sq ft hardware store on a 4.77 acre lot, built in 1994, with attached express or implied, is made as to the validity of the site, quality, quantity, weight, size, parking lot ******* MINIMUM BID: $346,141****** A parcel of land located in the Southwest Quarter of Section 26, Township 72 North, Range 10 West of the 5th Principal Meridian, Jefferson County, lowa, more particularly described as follows: Commencing at the Southwest comer of said Section 26, thence North 0° 00 East 1,327.8 feet, thence South 89° 46 1/2 East 313.85 feet to the point of beginning: thence South 0° 13 1/2 West 458.0 feet thence South 89° 46 1/2 East 200.0 feet; thence North 0° 13 1/2' East 458.0 feet thence North 89° 46 1/2 West 200.0 feet to the point of beginning, except a 33 feet strip of land running East and West along the North side of said described land which has been deeded for right-of-way purposes to U.S. Highway 34. Subject to all easements of record. Said tract is now known as IMPERIAL ADDITION to the City of Fairfield, Jefferson County, Iowa. And A parcel of land located in the Southwest Quarter of Section Twenty-six (26), Township Seventy-two (72) North, Range Ten (10), West of the 5th PM, Jefferson County, Iowa. Said parcel of land is more particularly described as Commencing at the Southwest comer of said Section 26, thence North 0° 00 East, 1327.8 feet, thence South 89° 46-1/2 East 513.85 feet to the point of beginning, thence South 0° 13-1/2 East, 458.0 feet thence North 89° 46-1/2" West, 292.0 feet to the point of beginning, now known as Trumbull Park Addition to the City of Fairfield, Jefferson County, Iowa. 0°13-1/2 West, 458.0 feet, thence South 89° 46-1/2 East, 292.0 feet. thence North EXCEPT: Apart of Trumbull Park Addition to the City of Fairfield, Jefferson County, Iowa, lying in the Southwest Quarter of the Southwest Quarter of Section 26, Township 72 North. Range 10 West of the Fith Principal Meridian, described mere particularly as follows: From the southwest comer of said Section 26, run North 0° 00' East along the west line of said Section 26 for 1327.8 feet to the north line of the Southwest Quarter of the Southwest Quarter of said Section 26: thence run South 89° 46' 30" East along said north ine for 805.85 feet to the northeast comer of said Trumbull Park Addition: thence run South 0° 13'30" West along the east line of said Trumbull Park Addition for 33.0 feet to the point of intersection of the south line of Burlington Avenue and the west line of 20th Street and the point of beginning; thence continue South 0° 13' 30" West along said east line for 60.0 feet thence run North 33" 28 West for 72.1 feet to the south line of Burlington Avenue; thence run South 89° 46 30° East along said south line for 40.0 feet to the point of beginning containing 1200 square feet and EXCEPT: or condition of any of the property, or its fitness for any use or purpose. No claim will be considered for allowance or adjustment or for rescission of the sale based on failure of the property to conform with any expressed or implied representation. Redemption Rights: The rights of redemption, as specified In Internal Revenue Code section 6337, Redemption of Property, are quoted as follows: Sec. 6337(a) Before Sale Any person whose property has been levied upon shall have the right to pay the amount due, together with the expenses of the proceeding, if any, to the Secretary at any time prior to the sale thereof, and upon such payment the Secretary shal restore such property to him, and all further proceedings in connection with the levy on such property shall cease from the time of such payment. Sec. 6337b) Redemption of Real Estate After Sale Period -The owners of any real property sold as provided in section 6335, their heirs, executors, or administrators, or any person having any interest therein, or a lien thereon, or any person in their behalf, shall be permitted to redeem the property sold, or any particular tract of such property at any time within 180 days after the sale thereof. Price-Such property or tract of property shall be permitted to be redeemed upon payment to the purchaser, or in case he cannot be found in the county in which the property to be redeemed is situated, then to the Secretary, for the use of the purchaser, his heirs, or assigns, the amount paid by such purchaser and interest thereon at the rate of 20 percent per annum, compounded daily How to Redeem Property advise of intent to redeem the property. If the purchaser is in the county where the asset is located, contact the purchaser to You must pay the amount of the purchase price plus 20% interest per annum, compounded daily based on the date(s) of the payment(s). Make payment to the purchaser, and obtain the certificate of sale. Notify the IRS to advise of the redemption. For more information on redemptions, go to https://www.irs.gov/businesses/small- businesses-self-employed redeeming-your-real-estate Effect of Junior Encumbrances: Sec. 6339(c). Effect of Junior Encumbrances. A certificate of sale of personal property given or a deed to real property executed pursuant to section 6338 shall discharge such property from all liens, encumbrances, and titles over which the len of the United States with respect to which the levy was made had priority. Address for information about the sale: all rights of direct access between Burlington Avenue and the property described Brittanny Dipla above. Property may inspected: drive-by only, do not disturb occupant(s). 51 SW First Avenue, M/S 800 PALS Miami, FL 33130-1608 Cell: (805) 479-2552 | Fax: (855) 864-6460 Payment Terms: Deferred payment as follows: 20% of your high bid at the time of Visit Us @www.irsauctions.gov Department of the Treasury - Internal Revenue Service Notice of Public Auction Sale Under the authority in Internal Revenue Code section 6331 , the property described below has been seized for nonpayment of internal revenue taxes due from CHARITON HARDWARE INC . sale and final payment due by 3:00 pm on December 20 , 2024 . Form of Payment : All payments must be by cash , a certified , cashier's , or treasurer's check drawn on any bank or trust company incorporated under the laws The property will be sold at public auction as provided by Internal Revenue Code of the United States or under the laws of any State , Temitory , or possession of the section 6335 and related regulations . Date of Sale : November 20 , 2024 Time of Sale : 11:00 AM with registration from 10:00 AM-11:00AM Place of Sale : 916 Braden Ave. Chariton , IA 50049 - front sidewalk of Lucas County Courthouse Tile Offered : Only the right , ste , and interest of CHARITON HARDWARE INC . in and to the property will be offered for sale . If requested , the Internal Revenue Service will furnish information about possible encumbrances , which may be United States , or by a United States postal , bank , or express money order . Make check or money order payable to the United States Treasury . Members of the public attending the auction are prohibited from carrying / possessing a firearm ( s ) at the auction , even if carrying possessing a fream ( s ) is otherwise permitted under state or local law . The term " firearm " means any weapon ( including a starter gun ) which will or is designed to or may readily be converted to expel a projectile by the action of an explosive . Nature of Tide : useful in determining the value of the interest being sold . ( See " Nature of Tide " for The right , title , and interest of the taxpayer ( named previously on this form ) in and further details . ) Description of property : 2100 W. Burlington Ave. Fairfield , IA 52556 APN 06-26-351-015 to the property is offered for sale subject to any prior valid outstanding mortgages , encumbrances , other liens in favor of third parties against the taxpayer that are superior to the lien of the United States . All property is offered for sale where is " and " as is " and without recourse against the United States . No guaranty or warranty , 35,769 sq ft hardware store on a 4.77 acre lot , built in 1994 , with attached express or implied , is made as to the validity of the site , quality , quantity , weight , size , parking lot ******* MINIMUM BID : $ 346,141 ****** A parcel of land located in the Southwest Quarter of Section 26 , Township 72 North , Range 10 West of the 5th Principal Meridian , Jefferson County , lowa , more particularly described as follows : Commencing at the Southwest comer of said Section 26 , thence North 0 ° 00 East 1,327.8 feet , thence South 89 ° 46 1/2 East 313.85 feet to the point of beginning : thence South 0 ° 13 1/2 West 458.0 feet thence South 89 ° 46 1/2 East 200.0 feet ; thence North 0 ° 13 1/2 ' East 458.0 feet thence North 89 ° 46 1/2 West 200.0 feet to the point of beginning , except a 33 feet strip of land running East and West along the North side of said described land which has been deeded for right - of - way purposes to U.S. Highway 34. Subject to all easements of record . Said tract is now known as IMPERIAL ADDITION to the City of Fairfield , Jefferson County , Iowa . And A parcel of land located in the Southwest Quarter of Section Twenty - six ( 26 ) , Township Seventy - two ( 72 ) North , Range Ten ( 10 ) , West of the 5th PM , Jefferson County , Iowa . Said parcel of land is more particularly described as Commencing at the Southwest comer of said Section 26 , thence North 0 ° 00 East , 1327.8 feet , thence South 89 ° 46-1 / 2 East 513.85 feet to the point of beginning , thence South 0 ° 13-1 / 2 East , 458.0 feet thence North 89 ° 46-1 / 2 " West , 292.0 feet to the point of beginning , now known as Trumbull Park Addition to the City of Fairfield , Jefferson County , Iowa . 0 ° 13-1 / 2 West , 458.0 feet , thence South 89 ° 46-1 / 2 East , 292.0 feet . thence North EXCEPT : Apart of Trumbull Park Addition to the City of Fairfield , Jefferson County , Iowa , lying in the Southwest Quarter of the Southwest Quarter of Section 26 , Township 72 North . Range 10 West of the Fith Principal Meridian , described mere particularly as follows : From the southwest comer of said Section 26 , run North 0 ° 00 ' East along the west line of said Section 26 for 1327.8 feet to the north line of the Southwest Quarter of the Southwest Quarter of said Section 26 : thence run South 89 ° 46 ' 30 " East along said north ine for 805.85 feet to the northeast comer of said Trumbull Park Addition : thence run South 0 ° 13'30 " West along the east line of said Trumbull Park Addition for 33.0 feet to the point of intersection of the south line of Burlington Avenue and the west line of 20th Street and the point of beginning ; thence continue South 0 ° 13 ' 30 " West along said east line for 60.0 feet thence run North 33 " 28 West for 72.1 feet to the south line of Burlington Avenue ; thence run South 89 ° 46 30 ° East along said south line for 40.0 feet to the point of beginning containing 1200 square feet and EXCEPT : or condition of any of the property , or its fitness for any use or purpose . No claim will be considered for allowance or adjustment or for rescission of the sale based on failure of the property to conform with any expressed or implied representation . Redemption Rights : The rights of redemption , as specified In Internal Revenue Code section 6337 , Redemption of Property , are quoted as follows : Sec . 6337 ( a ) Before Sale Any person whose property has been levied upon shall have the right to pay the amount due , together with the expenses of the proceeding , if any , to the Secretary at any time prior to the sale thereof , and upon such payment the Secretary shal restore such property to him , and all further proceedings in connection with the levy on such property shall cease from the time of such payment . Sec . 6337b ) Redemption of Real Estate After Sale Period -The owners of any real property sold as provided in section 6335 , their heirs , executors , or administrators , or any person having any interest therein , or a lien thereon , or any person in their behalf , shall be permitted to redeem the property sold , or any particular tract of such property at any time within 180 days after the sale thereof . Price - Such property or tract of property shall be permitted to be redeemed upon payment to the purchaser , or in case he cannot be found in the county in which the property to be redeemed is situated , then to the Secretary , for the use of the purchaser , his heirs , or assigns , the amount paid by such purchaser and interest thereon at the rate of 20 percent per annum , compounded daily How to Redeem Property advise of intent to redeem the property . If the purchaser is in the county where the asset is located , contact the purchaser to You must pay the amount of the purchase price plus 20 % interest per annum , compounded daily based on the date ( s ) of the payment ( s ) . Make payment to the purchaser , and obtain the certificate of sale . Notify the IRS to advise of the redemption . For more information on redemptions , go to https://www.irs.gov/businesses/small- businesses - self - employed redeeming - your - real - estate Effect of Junior Encumbrances : Sec . 6339 ( c ) . Effect of Junior Encumbrances . A certificate of sale of personal property given or a deed to real property executed pursuant to section 6338 shall discharge such property from all liens , encumbrances , and titles over which the len of the United States with respect to which the levy was made had priority . Address for information about the sale : all rights of direct access between Burlington Avenue and the property described Brittanny Dipla above . Property may inspected : drive - by only , do not disturb occupant ( s ) . 51 SW First Avenue , M / S 800 PALS Miami , FL 33130-1608 Cell : ( 805 ) 479-2552 | Fax : ( 855 ) 864-6460 Payment Terms : Deferred payment as follows : 20 % of your high bid at the time of Visit Us @ www.irsauctions.gov